How Much Is Property Taxes In Louisiana . our louisiana property tax calculator can estimate your property taxes based on similar properties, and show you how your. property taxes vary across louisiana based on county. louisiana property tax millage rates by parish. in louisiana, one mill is 1/10th of a 1 percent, or $1 for every $100 in value. In louisiana, the assessment level is set at 10% for residential properties. So if your millage rate is 200, and the taxable value is $20,000, you’d pay $4,000 in taxes. for residential property in louisiana, assessed value is equal to 10% of market value. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. homeowners in louisiana receive property tax bills in december. This bill will detail the tax rates of each taxing unit and how much you owe. The average property tax rate in louisiana is 0.55%. So if your home has a market value of $100,000, your assessed value.

from www.signnow.com

So if your millage rate is 200, and the taxable value is $20,000, you’d pay $4,000 in taxes. our louisiana property tax calculator can estimate your property taxes based on similar properties, and show you how your. louisiana property tax millage rates by parish. So if your home has a market value of $100,000, your assessed value. In louisiana, the assessment level is set at 10% for residential properties. This bill will detail the tax rates of each taxing unit and how much you owe. property taxes vary across louisiana based on county. homeowners in louisiana receive property tax bills in december. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. The average property tax rate in louisiana is 0.55%.

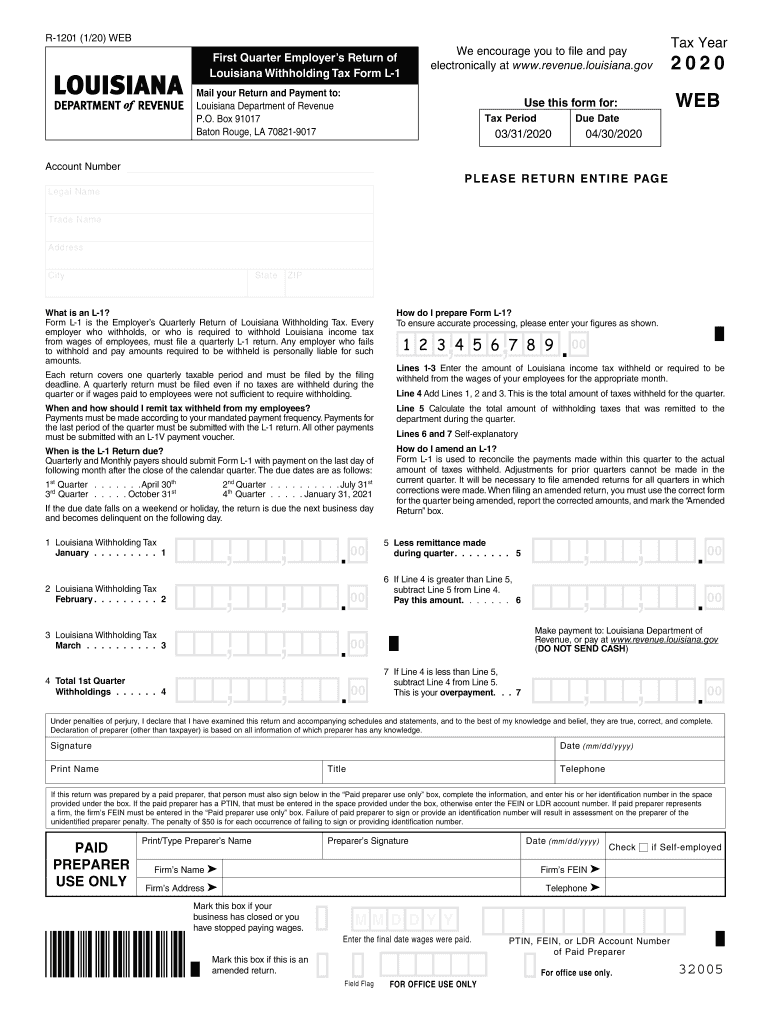

Louisiana L 1 4th Quarter 20202024 Form Fill Out and Sign Printable

How Much Is Property Taxes In Louisiana The average property tax rate in louisiana is 0.55%. homeowners in louisiana receive property tax bills in december. in louisiana, one mill is 1/10th of a 1 percent, or $1 for every $100 in value. property taxes vary across louisiana based on county. So if your millage rate is 200, and the taxable value is $20,000, you’d pay $4,000 in taxes. So if your home has a market value of $100,000, your assessed value. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. our louisiana property tax calculator can estimate your property taxes based on similar properties, and show you how your. This bill will detail the tax rates of each taxing unit and how much you owe. louisiana property tax millage rates by parish. The average property tax rate in louisiana is 0.55%. In louisiana, the assessment level is set at 10% for residential properties. for residential property in louisiana, assessed value is equal to 10% of market value.

From www.familyhandyman.com

States With the Highest and Lowest Property Taxes The Family Handyman How Much Is Property Taxes In Louisiana In louisiana, the assessment level is set at 10% for residential properties. So if your millage rate is 200, and the taxable value is $20,000, you’d pay $4,000 in taxes. for residential property in louisiana, assessed value is equal to 10% of market value. the median property tax in louisiana is $243.00 per year, based on a median. How Much Is Property Taxes In Louisiana.

From www.taxcreditsforworkersandfamilies.org

Louisiana State and Local Taxes in 2015 Tax Credits for Workers and How Much Is Property Taxes In Louisiana So if your millage rate is 200, and the taxable value is $20,000, you’d pay $4,000 in taxes. homeowners in louisiana receive property tax bills in december. our louisiana property tax calculator can estimate your property taxes based on similar properties, and show you how your. in louisiana, one mill is 1/10th of a 1 percent, or. How Much Is Property Taxes In Louisiana.

From acadiaparishchamber.org

Acadia Parish Ranks Third in Louisiana where Homeowners Get Most Value How Much Is Property Taxes In Louisiana The average property tax rate in louisiana is 0.55%. This bill will detail the tax rates of each taxing unit and how much you owe. property taxes vary across louisiana based on county. In louisiana, the assessment level is set at 10% for residential properties. in louisiana, one mill is 1/10th of a 1 percent, or $1 for. How Much Is Property Taxes In Louisiana.

From taxwalls.blogspot.com

How Much Is Property Tax In Los Angeles 2013 Tax Walls How Much Is Property Taxes In Louisiana property taxes vary across louisiana based on county. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. louisiana property tax millage rates by parish. homeowners in louisiana receive property tax bills in december. So if your home has a market value of $100,000, your. How Much Is Property Taxes In Louisiana.

From www.deskera.com

A Complete Guide to Louisiana Payroll Taxes How Much Is Property Taxes In Louisiana the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. The average property tax rate in louisiana is 0.55%. louisiana property tax millage rates by parish. In louisiana, the assessment level is set at 10% for residential properties. This bill will detail the tax rates of each. How Much Is Property Taxes In Louisiana.

From www.pinterest.com

Chart 2 Louisiana State and Local Tax Burden by Type of Tax FY 1950 to How Much Is Property Taxes In Louisiana This bill will detail the tax rates of each taxing unit and how much you owe. So if your millage rate is 200, and the taxable value is $20,000, you’d pay $4,000 in taxes. for residential property in louisiana, assessed value is equal to 10% of market value. our louisiana property tax calculator can estimate your property taxes. How Much Is Property Taxes In Louisiana.

From brokeasshome.com

louisiana tax tables How Much Is Property Taxes In Louisiana So if your millage rate is 200, and the taxable value is $20,000, you’d pay $4,000 in taxes. property taxes vary across louisiana based on county. In louisiana, the assessment level is set at 10% for residential properties. our louisiana property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web. How Much Is Property Taxes In Louisiana.

From propertytax.lacounty.gov

Unsecured Property Tax Los Angeles County Property Tax Portal How Much Is Property Taxes In Louisiana So if your home has a market value of $100,000, your assessed value. our louisiana property tax calculator can estimate your property taxes based on similar properties, and show you how your. In louisiana, the assessment level is set at 10% for residential properties. in louisiana, one mill is 1/10th of a 1 percent, or $1 for every. How Much Is Property Taxes In Louisiana.

From www.pinterest.com

Copy of a property tax bill for LA County. Property tax, Los angeles How Much Is Property Taxes In Louisiana our louisiana property tax calculator can estimate your property taxes based on similar properties, and show you how your. In louisiana, the assessment level is set at 10% for residential properties. So if your millage rate is 200, and the taxable value is $20,000, you’d pay $4,000 in taxes. louisiana property tax millage rates by parish. The average. How Much Is Property Taxes In Louisiana.

From www.stlouis-mo.gov

How to Calculate Property Taxes How Much Is Property Taxes In Louisiana The average property tax rate in louisiana is 0.55%. in louisiana, one mill is 1/10th of a 1 percent, or $1 for every $100 in value. In louisiana, the assessment level is set at 10% for residential properties. for residential property in louisiana, assessed value is equal to 10% of market value. louisiana property tax millage rates. How Much Is Property Taxes In Louisiana.

From hattianabella.pages.dev

Tax Rates 2024 United States Cayla Daniele How Much Is Property Taxes In Louisiana for residential property in louisiana, assessed value is equal to 10% of market value. our louisiana property tax calculator can estimate your property taxes based on similar properties, and show you how your. So if your home has a market value of $100,000, your assessed value. In louisiana, the assessment level is set at 10% for residential properties.. How Much Is Property Taxes In Louisiana.

From www.newsncr.com

These States Have the Highest Property Tax Rates How Much Is Property Taxes In Louisiana The average property tax rate in louisiana is 0.55%. In louisiana, the assessment level is set at 10% for residential properties. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. So if your millage rate is 200, and the taxable value is $20,000, you’d pay $4,000 in. How Much Is Property Taxes In Louisiana.

From usafacts.org

Where do people pay the most and least in property taxes? How Much Is Property Taxes In Louisiana So if your millage rate is 200, and the taxable value is $20,000, you’d pay $4,000 in taxes. property taxes vary across louisiana based on county. So if your home has a market value of $100,000, your assessed value. for residential property in louisiana, assessed value is equal to 10% of market value. In louisiana, the assessment level. How Much Is Property Taxes In Louisiana.

From www.dochub.com

Louisiana state tax Fill out & sign online DocHub How Much Is Property Taxes In Louisiana In louisiana, the assessment level is set at 10% for residential properties. So if your millage rate is 200, and the taxable value is $20,000, you’d pay $4,000 in taxes. So if your home has a market value of $100,000, your assessed value. our louisiana property tax calculator can estimate your property taxes based on similar properties, and show. How Much Is Property Taxes In Louisiana.

From www.youtube.com

Louisiana State Taxes Explained Your Comprehensive Guide YouTube How Much Is Property Taxes In Louisiana for residential property in louisiana, assessed value is equal to 10% of market value. So if your home has a market value of $100,000, your assessed value. In louisiana, the assessment level is set at 10% for residential properties. the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and. How Much Is Property Taxes In Louisiana.

From bayou-mortgage.com

Louisiana Property Tax Guide to Rates, Assessments, and Exemptions How Much Is Property Taxes In Louisiana in louisiana, one mill is 1/10th of a 1 percent, or $1 for every $100 in value. The average property tax rate in louisiana is 0.55%. homeowners in louisiana receive property tax bills in december. our louisiana property tax calculator can estimate your property taxes based on similar properties, and show you how your. for residential. How Much Is Property Taxes In Louisiana.

From www.signnow.com

Louisiana L 1 4th Quarter 20202024 Form Fill Out and Sign Printable How Much Is Property Taxes In Louisiana property taxes vary across louisiana based on county. So if your home has a market value of $100,000, your assessed value. This bill will detail the tax rates of each taxing unit and how much you owe. in louisiana, one mill is 1/10th of a 1 percent, or $1 for every $100 in value. So if your millage. How Much Is Property Taxes In Louisiana.

From www.whereyat.com

Study Shows Louisiana Property Taxes Remain Among the Lowest in the U.S How Much Is Property Taxes In Louisiana the median property tax in louisiana is $243.00 per year, based on a median home value of $135,400.00 and a median. So if your home has a market value of $100,000, your assessed value. In louisiana, the assessment level is set at 10% for residential properties. property taxes vary across louisiana based on county. louisiana property tax. How Much Is Property Taxes In Louisiana.